How Can Walmart Take Over Amazon?

Walmart is trying to take over Amazon. These strategies give us a chance to explore what Walmart's secret weapon could be. Read out blog to know more!

Regarding eCommerce marketplaces, you may have come across two of the most popular names: Amazon and Walmart.

While Amazon is a more common choice due to its huge market share, we believe Walmart has a really bright future because it is a curated platform for sellers. Therefore, the competition is a lot less than on Amazon.

Moreover, Walmart is beginning its journey with an already more aesthetically pleasing UI experience than Amazon. Its product selection is also naturally more thought-out.

All these benefits make it harder for people to qualify and become a seller on Walmart’s platform. You’ll have to present at least a year old eCommerce history with positive reviews, excellent customer service, and fulfillment integration with one of its solution providers or other eCommerce giants.

In this article, we compare Walmart and Amazon, highlighting the top benefits of becoming a Walmart seller.

1. Brand Exposure

Walmart Marketplace has the biggest brand exposure in the US because of its physical presence, equipped with the most sophisticated infrastructure, and highest profit margins.

Even though Amazon plans to build its first 30,000 sq. ft. retail stores in California and Ohio, these stores are still less than one-third the size of Walmart's conventional outlets (and about one-sixth the size of Walmart Supercenter stores!)

2. Walmart’s Innovation & Technology

Walmart is investing heavily in technologies to support a seamless digital customer experience. It is spending almost $14 billion to increase supply chain capacity, boost productivity, and improve the customer experience by ensuring products are in stock to meet demand.

In 2020, Walmart introduced Alphabot, a platform that can pick, pack, and deliver online grocery orders faster and more accurately than humans deliver. It also redesigned a thousand stores in 2021 to create a more streamlined and faster consumer shopping experience. The new design relies heavily on increased signage and an updated app to point consumers to the exact location of every product, blurring the line between online and in-store shopping.

3. Financial Performance & Stocks

The COVID-19 pandemic triggered more online sales, due to which both Amazon and Walmart experienced a big jump in sales. In the financial markets, Walmart stock managed a gain of 4.35% in 2021, whereas Amazon stock had a gain of 2.5% in that period.

According to stock analysts, Amazon stock has struggled since reporting unsatisfactory results in July 2021, whereas Walmart stock is gaining steadily and could be near a breakout.

4. Walmart’s Market Growth over Amazon

Walmart’s growth rate is much stronger than Amazon’s. From 2019 to 2021, Walmart’s revenue almost tripled, whereas Amazon’s revenue increased by about 35%. In 2019, for instance, Amazon’s revenue was almost 14 times more than Walmart’s. In 2021, Amazon’s revenue was six times more than Walmart’s. Even though Amazon has an impressive 40.4% market share over Walmart’s market share of 7.1%, Walmart’s share is quickly growing and is expected to reach 12.7% by 2026.

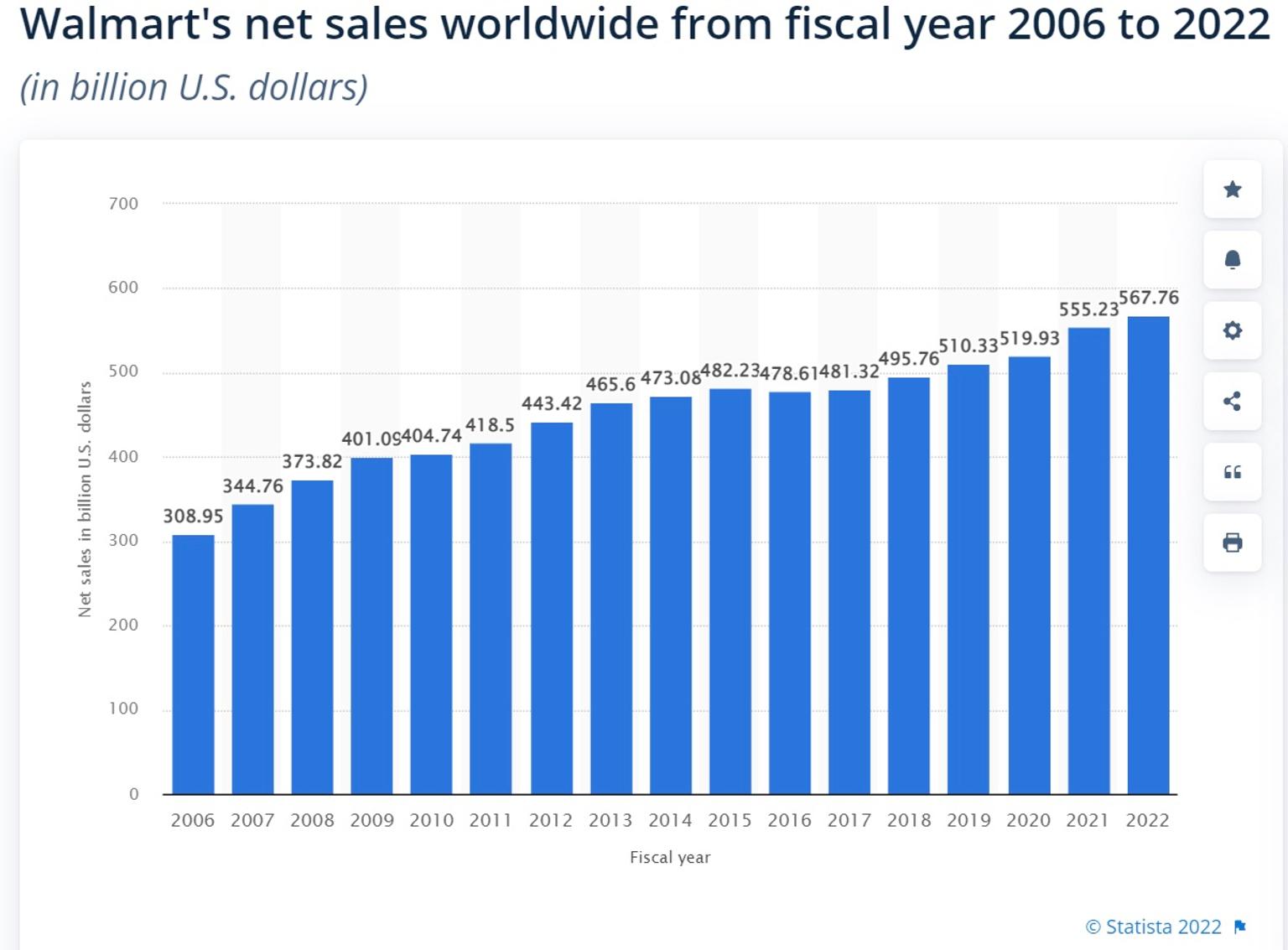

5. Gross Revenue

In 2021, Walmart generated worldwide net sales of over $555 billion dollars, an increase of about 6.8% compared to the previous fiscal year. The company’s gross profit margin has remained steady at around 25% over the last several years.

Source: Statista

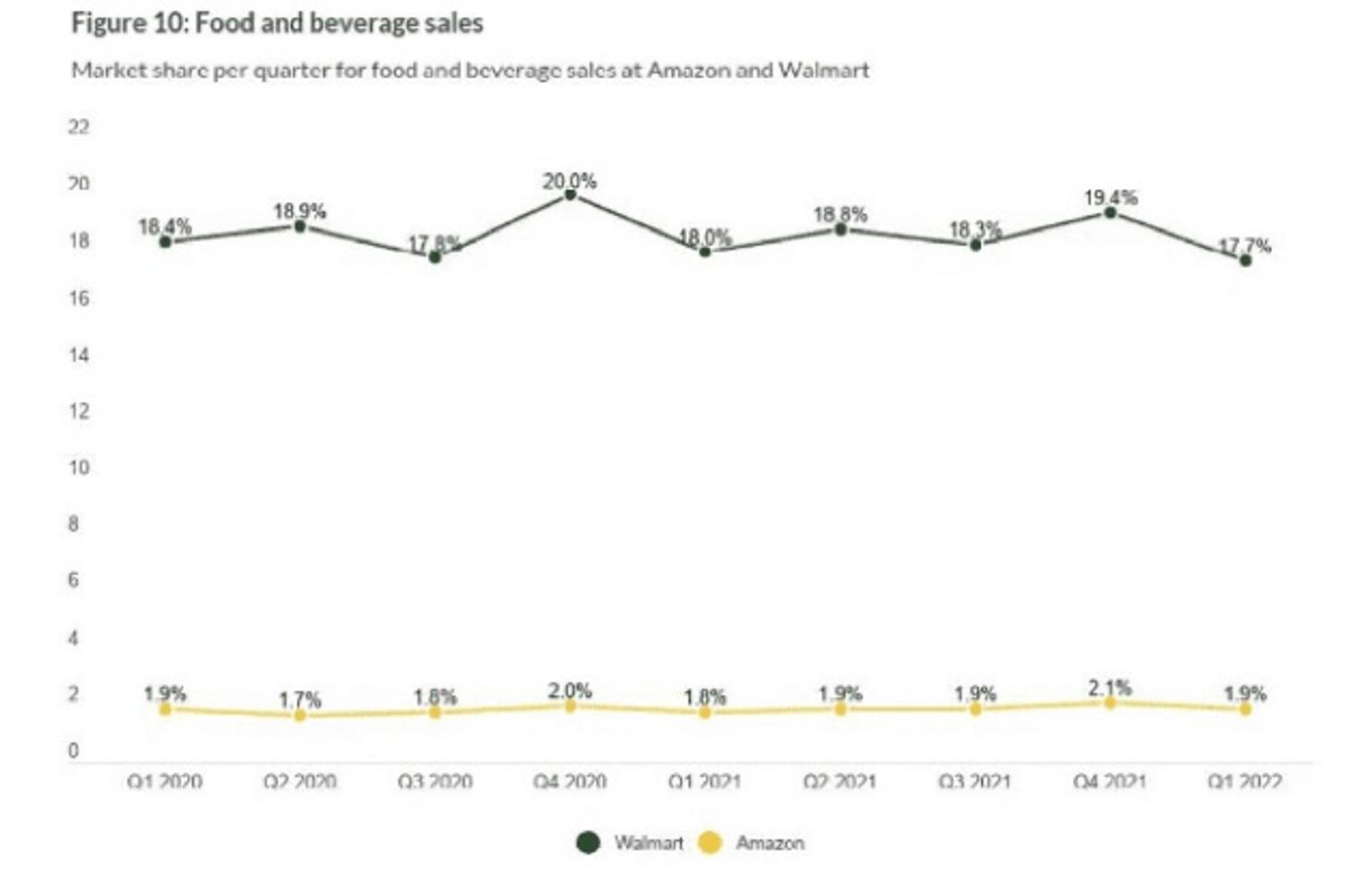

As of 2021, Walmart operated more than 11,000 stores throughout the world, and this figure is more than likely to increase as the company continues to expand into emerging markets. Walmart had an 18% sales share in the food and beverage category, whereas Amazon only had a 2% share. Therefore, it wouldn’t be wrong to say customers prefer Walmart over Amazon in certain categories, such as grocery.

Source: PYMNTS

As of January 2022, Walmart marketplace reported total revenue of $152.87 billion worldwide, a 0.5% increase from Q1 2021. In the US alone, Walmart reported $105.3 billion in total sales during Q1 2022, a 5.7% increase from Q1 2021. The growth of Walmart is especially notable since we entered the post-pandemic era and consumer tendency still shows an increase in online sales despite the physical shopping option.

6. Customer Behavior

For millions of consumers, Walmart is their main source to buy groceries, household items, clothing, and more. In 2021, Walmart saw about 240 million customer visits every single week. It also operates a successful eCommerce site, which is particularly busy around the beginning of the holiday season.

According to a 2020 survey, 75% of customers who purchased from discount chains in the last 12 months bought from Walmart. Meanwhile, in the same survey, 66% of respondents also claimed to regularly purchase food and products from Walmart.

7. Selling Fees

The professional selling plan for Amazon costs $39.99 a month with a referral fee for each sale, usually ranging between 8% and 15%. On the other hand, Walmart doesn’t charge any amount for setting up an account. However, just like Amazon, it imposes a referral fee of 8% to 20%, depending on the item type.

Launch Your Walmart Store with AWM

Undoubtedly, Walmart is on the rise, so a seller has more opportunities, fewer competitors, and fewer extra costs than Amazon. Walmart will soon be a future online retail giant to keep up with Amazon’s progress. Therefore, it’s smart to prepare for the future and launch your store at Walmart.

Our Walmart automation and consultancy services help you establish a profitable storefront on Walmart and diversify your income through a store on Amazon or Facebook. Get in touch to learn more about how we can help you set up a Walmart store